EDITOR’S NOTE: Among the many Zoom meetings and presentations I’ve been in on this year, one that got me thinking about a whole new aspect of the packaging supply chain took place in late January. Its title was “Optimizing Your Supply Chain by Improving Supplier Performance and Creating Value.” It was sponsored by F4SS (Foundation for Strategic Sourcing), and the key presenter was Alan Day, Chairman and Founder of State of Flux, a global leader in supplier management technology and services. In recent conversations with Day, he introduced me to a few Consumer Packaged Goods companies where management thinks very highly of the idea that supplier performance is a key to success. In fact, these companies have formalized their efforts and ideas on the topic into a strategy known as Supplier Relationship Management, or SRM. What follows is a synopsis of Day’s January presentation, which he was kind enough to share with me so that I could walk through it with him on the phone on a one-on-one basis. Augmenting Day’s observations are contributions from SRM experts at Mars and Kellogg.

Please, not another acronym. That was my first thought early this year when SRM first crossed my radar screen. But it didn’t take long to realize that, yes,  Figure A—Alan Day of State of Flux describes SRM as consisting of six main pillars that are all interconnected.

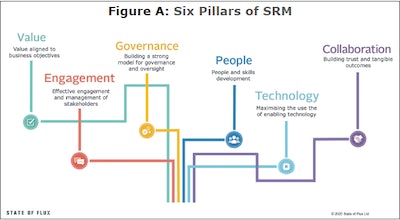

Figure A—Alan Day of State of Flux describes SRM as consisting of six main pillars that are all interconnected.

Fundamentally, SRM is a strategy built on the recognition that obsessing over cost and cost alone is not as beneficial as taking a long-term view that promotes the success of both customers and suppliers. Alan Day of State of Flux, a leading supplier management technology and services organization, describes SRM as consisting of six main pillars that are all interconnected (Figure A). Each is many-faceted and worthy of lengthy discussion and analysis. But Day boils it down to these condensed descriptions:

• Value—Are you getting risk reduction and innovation from the relationship? Can you measure these things, and is what you’re getting aligned with your fundamental business objectives? When it comes to value, I want to focus on key opportunities here. Leaders in SRM are focusing on growth and innovation, especially in the CPG space. We are also seeing that we need to close the gap in where that value definition is. In the past, “value” generally equaled “price.” But now we’re starting to see it can also mean things like risk reduction, access to scarce resources, joint go-to-market opportunities, and access to innovation.

• Engagement—One of the challenges with SRM is that it needs to be business-wide. It can’t be just about procurement. There’s no point in a procurement person saying this supplier is strategic if the business doesn’t treat the supplier that way. And if SRM is going to succeed, there must be support from the C-Suite on down.

• Governance—This is where we talk about segmentation, treatment strategies, processes, and building a kind of governance structure to manage supplier relationships. Segmentation is so important. A key is to make sure that, first, you’re focused on the right suppliers and you’re putting effort where effort is required. That’s what segmentation is about. And in your segmentation efforts, don’t just look at criticality and spend. Look at other factors like access to innovation, or even ask yourself if the supplier sees you as strategic. Not much point in you trying to work with them strategically if they don’t see you as a strategic customer. We suggest you map out the org chart for both organizations—yours and the supplier’s—and then you note down the responsibilities on those charts. I understand that some of these relationships are massive, but it’s very interesting once you start mapping out the touch points and seeing what overlaps and what controls are missing.

• Technology—This underpins it all, especially in a world of COVID-19, where it’s more difficult to go and visit your suppliers in person. With key suppliers, use technology to enable interactions—governance meetings, evaluations of potential risk, innovations that are surfacing, opportunities, etc. And then in terms of suppliers who rank lower in your segmentation, leverage technology to automate those relationships. So you want to think about how to automate supplier performance in such a way that purely administrative transactions can perhaps be entered by the supplier. Speaking of technology, specifically in the software arena, it’s positively scary to think that 86% of organizations use Excel, the hacker’s favorite tool, as their main tool for managing suppliers.

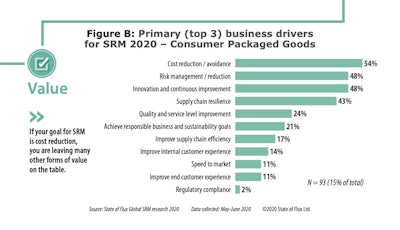

• People—This is all about looking at skill sets and job descriptions. It’s amazing how many people manage suppliers as part of their day job but it’s not in their job description. Too often, it’s not clear who is actually responsible for SRM. So if it gets done at all, it gets done by the seat of the pants. It’s rarely formalized. And it’s certainly not a full-time job. Now compare SRM with CRM (Customer Relationship Management). When it comes to CRM, you have key account managers. Not only is theirs a full-time job, they get training and full IT support and technology to back them up. And isn’t it curious that if you are in sales at a CPG company, the more years and experience you have under your belt the fewer customers you are assigned to manage, until you might be responsible for just one key account. But if you are in procurement at a CPG company, the more years and experience you have under your belt, the more suppliers you are asked to manage. So you might have one person looking after 60 suppliers. That’s a complete mismatch. Figure B—Here’s how respondents from CPG companies ranked business drivers making SRM attractive.

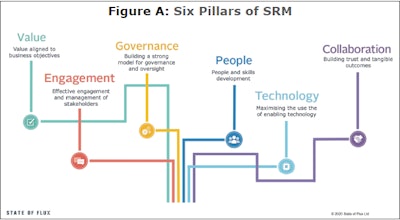

Figure B—Here’s how respondents from CPG companies ranked business drivers making SRM attractive.

• Collaboration— This is really an output of the other five pillars. We recommend running a 360-degree review. It’s a matter of understanding how you’re viewed from the supplier’s point of view. Work toward what we call a “joint account plan” rather than a “sales account plan.” That means working in collaboration with your supplier and building lots of trust.

Leaders, Fast Followers, Followers

Day believes that if a company is well established in four of these six pillars, that firm is a “Leader” in SRM. “Fast Followers” are established in three of the six, and firms that are well established in less than three are “Followers.” In the State of Flux Global SRM research for 2020, the twelfth edition of this annual study, only 17% of respondents identified themselves as Leaders, 23% as Fast Followers, and 60% as Followers.

The State of Flux research also asks respondents to identify the business drivers making SRM attractive (Figure B).

While Cost Reduction/Avoidance remains at the top of the list with 54% of respondents picking it as important, three drivers nipping at its heels are Risk Management/Reduction, Innovation/Continuous Improvement, and Supply Chain Resilience. “The 2020 research was done in May 2020, so the impact of COVID-19 had not really made itself felt,” notes Day. “I’m expecting that Supply Chain Resilience and Improving End Customer Experience will gain in importance when we see the 2021 results.”

Michele Van Treeck, Chief Procurement Officer & VP Global Procurement at Battle Creek, Mich.-based Kellogg Co., also believes the pandemic’s impact on the supply chain will rearrange priorities. But she sees other influences, too.

“In addition to a year of COVID-19, there were numerous other events and changing trends that impacted buyers and sellers alike, some of which continue into the present. Everything from record-breaking cold snaps and other weather anomalies that disrupted many supply chains, to changes in regional and global trade, regulations, logistics and labor markets that have become the norm,” she says. “After a year like that, I would expect Supply Chain Resilience, Risk Management, and suppliers who can partner to creatively solve problems and support customers and our growth to become more desirable than ever.”

Rachael Tomasello, Head of SRM at McLean, Va.-based Mars Inc., believes that having an established SRM program in place as COVID-19 rearranged the supply chain paid big dividends.

”We saw incredible growth in our food business and in our pet care business as the pandemic took off,” says Tomasello. “It was our supplier relationships that helped us meet this unforeseen demand. Key suppliers viewed us as a customer of choice because we’d established a relationship of sharing with them our challenges and our goals. Putting in the time and the resources into building those relationships was an investment that really paid off.” Rachael Tomasello is Head of SRM at McLean, Va.-based Mars Inc.

Rachael Tomasello is Head of SRM at McLean, Va.-based Mars Inc.

SRM as a philosophy

SRM at Mars isn’t viewed as traditional procurement but rather as part of a larger commercial function. “It’s a mindset where we see ourselves as being a larger partner in the business as opposed to being responsible for just buying something,” says Tomasello. “So we go beyond just getting the best price for materials or services. We look at value delivery mechanisms, at how best to drive innovation, at how best to deliver on our sustainability goals, at how to ensure that we’ve got the right diversity in our supply base. When you think about driving value from this perspective, you get better results when you work with suppliers whose strategies align with yours and you can really leverage the full benefit of their capabilities.

“We look at it this way. We’re experts in our core competency of making and selling our products, but we’ve got a massive extended supply chain brimming with experts in what they do. SRM is what allows us to take a really intentional view of what our business strategy is and who we should be partnering with to deliver on that strategy.”

Kellogg’s Van Treeck echoes Tomasello’s thoughts on how SRM can support mutual growth as well as be an effective tool to enable supplier diversity. She defines supplier diversity as an integrated business strategy where “the goal is to purchase from suppliers who represent the diversity of our customer and consumer base. The diverse solutions, perspectives, and innovation that are created with diverse partners enable positive impact on the communities in which we collectively operate, support growth for our businesses, and are viewed positively by employees and consumers alike,” says Van Treeck. She adds that diverse suppliers to Kellogg are independently certified as well.

Kellogg appears to be among the CPG companies that are not new to the practice of SRM. According to Van Treeck, it was in place when she joined the firm more than 15 years ago, though she says it has continuously evolved from a performance measurement program (those roots remain) to end to end strategic relationship management. For example, four years ago the firm enhanced its program with the implementation of K Partner Advantage, whose tagline is “A recipe for shared success.” One component that has remained central to Kellogg’s SRM approach is the idea of segmentation that State of Flux’s Day believes is so important.

Michele Van Treeck is Chief Procurement Officer & VP Global Procurement at Battle Creek, Mich.-based Kellogg Co.

Michele Van Treeck is Chief Procurement Officer & VP Global Procurement at Battle Creek, Mich.-based Kellogg Co.

Another believer

Also a big believer in the importance of supplier segmentation is Tomasello. “We spend the most resources on suppliers that are going to deliver the most strategic initiatives with us—not for us but with us,” she says. “The other suppliers? It’s more of a business-as-usual relationship.”

When asked if she thinks there is a danger to over-obsessing about cost, Van Treeck says absolutely yes. “If we focus only on cost, it means we are without that thing that makes suppliers want to support our business and growth. It’s the same thing that makes us want to partner with those longer-term-focused suppliers that can operate in what we call the ‘and world.’ As in, ‘quality and safety and service and price and sustainability and supplier diversity and all of that stuff that helps us really be great at serving the needs of our customers and consumers.’ And then think about last year. Because of the SRM program and strong foundation of segmented partners and strategic relationships, we knew which partners were keenly attuned or had shared purpose or interest in which issues or opportunities, we knew who to reach out to, and we knew what we could ask for or who to partner with to create change and impact. We and our suppliers made each other better.”

For more on how collaboration along the supply chain pays dividends, go here.

Both Van Treeck and Tomasello think sustainable packaging will be at the very core of SRM for the foreseeable future. “I think sustainable packaging and SRM are intrinsically linked,” says Tomasello. “When we look at our suppliers of packaging materials, the way they operate and how they do business has an obvious impact on our ability to meet our sustainability targets. So if a supplier has an asset base that is not focused on sustainability, and they’re not making any upgrades in that direction, and they’re not getting on board with that agenda, then long term it will be more difficult to do business with us because we have sustainability targets we have to meet.”

“Nurturing our planet and functional, sustainable packaging go hand in hand; strategic partners certainly have a role to play,” says Van Treeck. “While it’s early days and much work is ahead, we’ve been able to work with supplier partners to come up with multiple options to meet our goals. It’s not just seeing one solution and buying it off the shelf. It’s more a matter of continuing to have a shared purpose and objective, and collaborating and leveraging each other’s brains, energy, and knowledge as we look to design, implement, and go to market.”

PACK EXPO Las Vegas and Healthcare Packaging EXPO (Sept. 27-29, Las Vegas Convention Center) will reunite the packaging and processing community. With over 1400 exhibitors, no other event in 2021 will bring together a more comprehensive gathering of suppliers offering new products, technologies and solutions. Attendee registration is now open.