Robot installs are predicted to surpass a significant benchmark by 2024, reaching 500,000 installs in a single year, according to PMMI Business Intelligence's 2022 report "Robots and Cobots – An Automated Future."

This prediction comes after some fluctuation in recent years, including the COVID-19 pandemic and other factors that brought turbulent CAGRs.

Global annual robot installations increased by a CAGR of 9% from 2015 to 2020, driven primarily by additions enabled through the growth of robotics technology into new capabilities and applications. As one industry expert says in the report, “the advancements in sensors, AI vision systems, and machine learning are opening up huge opportunities for robotics around the world.”

Installations grew slightly to 383,545 in 2020, exhibiting a CAGR of 0.5% from 2019-2020. This increase marked a recovery from the 10% decline experienced during 2019.

Preliminary 2021 data shows the total value of new global robot installations reached $13.2 billion in that year, with more than 3 million robots operating in factories around the world.

While install growth for 2021 is predicted to rebound strongly as the effects of the pandemic fade, this “boom after the crisis” is predicted to slow by 2022. Global CAGRs for new installs are predicted to level out in the medium single-digit range for 2021 to 2024, eventually reaching the 500,000 single-year milestone.

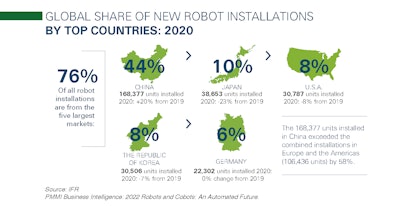

New Robot Installations by Country/Region

Global 2020 data shows Asia (including Australia and New Zealand) is now the single largest robotics market, occupying 70% of the global share of new installations. Over 266,000 units were installed in 2020, up 7% from 249,598 units the year before. Asia outpaced the global 2015-2020 CAGR with a CAGR of 11% in that timeframe. China leads this region with 168,377 units installed in 2020, a 20% increase from the year before.

Growth in Asia is predicted to remain strong, likely creeping into the high single-digit or low double-digit range. Asia will remain the dominant regional market for installs during the forecast period.

Installation growth for Europe is predicted to slow, dropping below the global average into the low single-digit range. Central and Eastern Europe are expected to perform stronger than Western Europe during the forecast period.

The Americas take up 10% of new installations in 2020. Installs in the Americas dropped by 17% in 2020, with declines in the U.S. (-8%), Mexico (-26%), and Canada (-29%). Effective CAGR for the Americas was 0% from 2015-2020. The U.S. covers 8% of global installations with 30,787 in 2020, down 8% from 2019.

The North American market is predicted to exhibit slightly stronger growth than the global average at a CAGR of 10% for the forecast period.

Source: PMMI Business Intelligence, 2022 Robots and Cobots: An Automated Future.

Download the FREE report below.