Emily Friedman, plastics expert and senior editor at ICIS

Emily Friedman, plastics expert and senior editor at ICIS

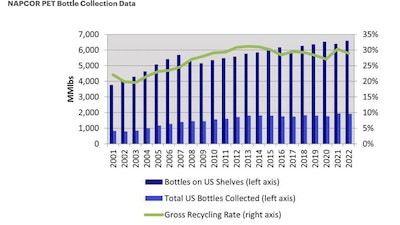

“That’s a known, traditional pattern in the rPET space,” Friedman says. “But this year is interesting. We’re coming off very weak demand in 2023—many analysts venture that rPET demand was down as much as 15% in 2023—and we saw depressed prices throughout the whole year, not just at that late summer period.”

Why was that? One factor was destocking efforts to counteract COVID-era oversupply. During the pandemic, when supply chains were uncertain and demand for single-use PET was very high, reprocessors, converters, and brands all overpurchased rPET raw materials or preforms. Stakeholders needed to work through that oversupply slack to get back nearer to just in time (JIT) inventory management patterns, temporarily depressing demand. Also, as global economies started to flip from hot to cold last year, consumer spending has gotten tighter and weaker. Friedman says that while the destocking efforts of 2023 have largely subsided, consumer softness remains.

“When that bottom-line pressure begins, it becomes a real question if consumer brand companies are willing to stick to those voluntary sustainability goals when PCR material is going to be more expensive than what they can find on the virgin market,” Friedman says. “It became a two-fold issue in recycled plastics where not only is raw demand going down, but [CPG and FMCG] companies might be scaling back or pushing off programs intending to use recycled content.”

When asked whether this was a harbinger of a larger potential trend—brands and CPGs seeing profitability and sustainability as at odds, and naturally choosing profitability—Friedman is careful to point out that brands and CPGs are by no means a monolith, and can’t be easily lumped together.

“I really hesitate to say that brand companies are generally backing off [sustainability commitments] right now, but I know some of my market contacts have customers who have withdrawn or lowered orders of rPET. We also see some of them going to imported volumes of rPET rather than domestic volumes, and that significantly impacts the local rPET market.”

When freight is reliable and inexpensive, importing less expensive foreign rPET can be a way to keep costs down and still hit recycled content goals—though it could be argued that shipping that content from Asia or Latin America is purpose defeating. But recent global freight instability in Panama and Middle East passages have import prices rising, perhaps buoying local rPET. Still, as we pivot into 2024’s edition of preform season, we’d expect to see some of the supply bale tightening, which Friedman confirms we have seen, and some upward price pressure because of that.

“But we still are seeing very weak demand downstream, which has filtered into currently stagnated bale prices,” Friedman says. “And it’s very shocking to see, across both east and west coasts since they’re different markets for PET and rPET. But we’re seeing flat to soft market demand in this pricing, a lot lower than what we would typically see at this time. It’s very much counter to trend… rPET markets being unexpectedly weak shows that not all brands are increasing their PCR content, and sustainability is not a harmonious effort across all consumer brands companies. If that were true, we’d see higher prices and maxed out demand.”

A silver lining might be that all this softness is evidence of a larger soft landing—ICIS economists have concluded that the recession predicted has been largely avoided, and cheerier economic climes await in Q2 of 2024. But a sobering takeaway might be that circularity in the plastics markets is a luxury for fat and happy brand owners, and when belts must be tightened it becomes more of a nice-to-have than a gotta-have. PW