Bart Watson, Chief Economist for the Brewers Association, ended his DiMaggio-like streak of annually delivering rosy industry growth numbers to a craft brewer audience at the Craft Beer Conference. But he didn’t shock anyone at the Denver Convention Center with the news that—for the first year since anyone can remember—2020 was a bummer of a year for craft beer. It was a bummer of a year for most folks.

Describing a downward trend for once wasn’t Watson’s only break from tradition. Most years, the Craft Brew Conference happens in March or April, and his esteemed annual State of the Industry acts as timely retrospective of the previous year, ended only a few months prior. But by delivering the State of the Industry in September, six-months later than usual, he found himself dealing with an irregular 18-month interval. Though 2020 was bleak, some better news has come since it ended.

| Watch this brief 5-minute video summarizing and highlighting the biggest takeaways from Bart Watson's recent Craft Brew State of the Industry Address. |

So, what has happened since December 2020, which would normally be the end of Watson’s annualized data set? Vaccines and a re-opening of foodservice and public gatherings vaulted at least some of America toward a greater degree of normalcy. This has people back in bars and taprooms, resulting in a slow shift back toward pre-pandemic sales channel mixes for craft brewers.

Of course, this isn’t universally the case, and we’re not out of the pandemic woods yet. It appears that despite the appearance of a return to pre-pandemic norms, the pandemic may have permanently changed the channel mix. All the while, generational and demographic shifts imperceptibly move, like continental drift, away from craft brew’s hay-day and biggest growth years in the 90s and 2000s. Craft brew is now a maturing market that needs to reinvent itself if it wants to keep growing.

“We're excited for things starting to return to normal, excited to be back together, but there's still apprehension about future shocks, about the supply chain, and about what [COVID-19 mutation] Delta may do in future iterations to your business,” he says. “We're an industry in transition. And, more importantly, we're an industry that's different than it was before.”

A 2020 autopsy

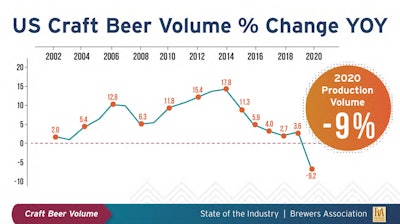

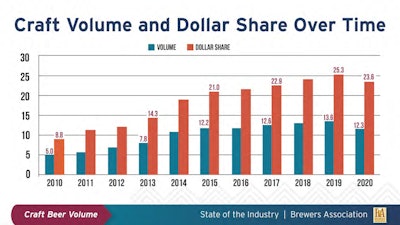

“Last year, 2020, was obviously a very challenging year for the craft brewery business, driven by huge channel shifts,” he said. “Overall, Americans actually drank a similar amount of beer in 2020 as they had the year before, but they drank it in radically different places. That meant a lot less in bars and restaurants, and a lot more from packaged [retail] stores. And that's challenging for craft brewers, who tend to over-index in bars and restaurants where they have almost 30% share, and under-index in places like grocery stores and liquor stores where they have less than 10% share.” In 2020 compared to 2019, for the first time in recent history, year-over-year craft brew volume was down.

In 2020 compared to 2019, for the first time in recent history, year-over-year craft brew volume was down.This led to the first decline in production—negative 9%—since the Brewers Association started measuring craft brewing statistics in the mid 1980s. If revenue or profit statistics were available (they weren’t), Watson believes the numbers would be even lower since many brewers made up some of the lost volume with lower revenue-per-barrel and higher cost strategies like pivoting from pints in brew pubs and tap rooms, to packaging in retail. This is a great strategy to make up some sales, but it entails additional costs.

That meant that craft beer dollar share also dropped, alongside volume. The good news for the industry is that craft brewers still sold about one out of eight beers. And out of all money spent on beer, one out of four still went to small and independent brewers. But these were steps back, not forward, for craft brewers. In addition, the total retail pie for craft beer shrunk even more than those volume numbers. Again, this was driven by that channel shift since people tend to spend more money on beer in bars and restaurants than they do in packaged stores, according to Watson.  Craft brew volume and dollar share were both down, year-over-year, between 2019 and 2020.

Craft brew volume and dollar share were both down, year-over-year, between 2019 and 2020.

As stands to reason, the packaged beer boom in 2020 came at the expense of draft beer sales in restaurants and taprooms. Before the pandemic, draft beer on-premise occupied between 10% and 12% of the market. That dropped to 2% during the pandemic, essentially eliminating draft beer in the U.S. for a time.

“Even in the summer [of 2021], as things were almost fully reopened, we only got back to 8% of the beer market being draft,” Watson says. “So, clearly, things have changed, driven by channel shift and different consumer preferences.”

Craft beer’s current “liminal state”

In an attempt to precisely describe the current, September 2021 state of the industry, nine months onward from the sobering end-of-2020 stats, Watson landed on the word “liminal.”“It comes from the Latin word meaning threshold, and it means a transitory or a crossing over space. And we're really an industry in transition, in between a lot of different things. The numbers are in between 2019, and where we were when we dropped in 2020,” he says. “We're in between the depths of last year, but we're clearly not still to a full recovery. Many breweries are still in between business models, maybe doing a little bit more packaging than you did before, and adding new elements that you hadn't done before, but not necessarily where you're going to be in a year or two. The industry and many individual businesses are between success and collapse. When I talk to brewers and ask them how things are going, I rarely get a ‘terrible,’ and I rarely get a ‘great.’ For a lot of businesses, there are opportunities and challenges.”  Watson's depicts the state of the industry as "liminal," or in a state of transition or flux.

Watson's depicts the state of the industry as "liminal," or in a state of transition or flux.

Sometimes those opportunities can be difficult to pin-down. Depending on how you slice them, the numbers can tell different tales. And though those tales intuitively feel at odds with one another, they’re not—they’re all correct. It’s a matter of interpretation.

For instance, the industry is selling more packaged beer right now than it did in 2019, about 5% more. But if you compare that to the retail and packaged sales boom in the pandemic last year, in 2020 sales, they're down by around 10%.

Another example is by volume, the industry is expected to grow by nearly 8% in 2021, by more than 1.7 million barrels. But that outwardly respectable percentage is an artifact of the greatly diminished base number from which that growth stems. Another way to put it is as follows. If the pandemic hadn’t happened at all, and the industry steadily grew 3% year-over-year (a conservative estimate), it’s revealed that the strong growth this year will still come to 2 million barrels less than likely would have been produced if the pandemic hadn’t hit.

“Which of these perspectives is the correct one? They both are,” Watson says. “And this is where this industry in transition. We need to look at it in various ways, in order to understand what's going on with sales. But it makes it really hard to plan around.”

Input costs rise, but brewers slow to pass it on to consumers

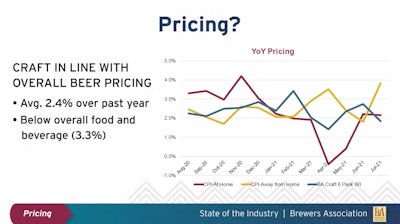

"Over the past year, we've heard about supply chain challenges for basically everything that goes on in a brewery—aluminum cans, CO2, pallets, cardboard, trucking and shipping, not to mention your labor. Some of these were driven early on by demand spikes during the pandemic. Why do we have a can shortage? Well, we as a country bought a lot more cans. When suddenly you stop going to bars and restaurants, and you're only shopping in grocery stores, you need a lot more cans,” Watson says.Well, those pandemic-based demand irregularities are largely over. But that unfortunately means that the supply chain challenges brewers continue to experience today suggest that these issues weren’t simply demand-based, and instead are going to last a lot longer.  Signal through the noise: this graph is erratic, but the takeaway is that craft beer prices to consumers aren't keeping pace with input costs.

Signal through the noise: this graph is erratic, but the takeaway is that craft beer prices to consumers aren't keeping pace with input costs.

This translates to continued higher pricing on the inputs enumerated above. But year-over-year craft beer (and all beer) price increases (2.4%) continue to lag overall food and beverage year-over-year price increases (3.3%). Craft brew as an industry asked for less of a price increase than it has taken in input costs, indicating a reluctance among craft brewers to pass the increases along to consumers.

“One reason brewers may be wary of passing on price is that we’re all hoping many of the supply chain shocks are transitory, that the cost associated with these supply chain disruptions hopefully are going to go away, and maybe those costs are going to go back down,” Watson says. “And so if they're not going to last, you may be wary of passing on cost increases to your customers.”

The less hope-driven reality likely at play is that the market is maturing, and there’s just more competition. In general, volumes are lower first half of 2021 than they were in the first half of 2019, meaning more breweries are fighting for a smaller pie. And in this case, keeping price low can be a strategy to earn a bigger piece of a smaller pie. But at some point, something’s got to give between input costs and price. Margin and profit are sacrificed on the altar of competitive pricing at a rate that not every craft brewer can endure.

Watson warns against applying these aggregated generalities to any given brewery, as cutting the data by brewery vs. by aggregate barrel volume can paint a more optimistic picture. The overall message remains, it’s mixed and in transition.

| Check out these other recent craft brew stories featured in Packaging World. All can be found in the PACKAGING FOR CRAFT BREW supplement. Read the Digital Edition of the publication by clicking the blue link. |

“There is growth out there, it's just not evenly distributed,” he says. “At the same time, about half of breweries said, ‘We're still below [in the first half of 2021] where we were in [the first half of] 2019 … There are variations by region and approach just like there always have been. But I think we're seeing in the data that those [variations] are widening right now, and the pandemic is picking winners and losers more than ever before.”

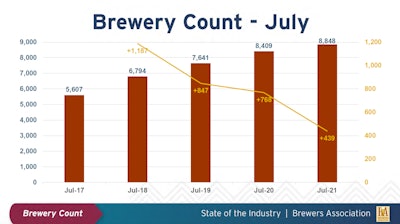

Brewery number keeps growing, but pace slows

“If you asked me at the beginning of the pandemic, ‘Are we going to have more or fewer breweries a year from now?’ I would have guessed fewer. And I was wrong,” Watson says. “We have more breweries now.” Brewery count continues to grow, but pace of growth is slowing as new openings (yellow line) are decreasing and closings remain stagnant.

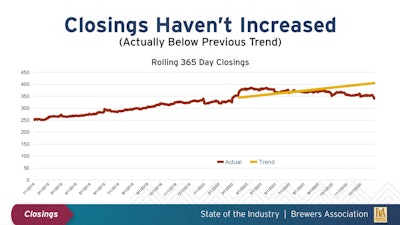

Brewery count continues to grow, but pace of growth is slowing as new openings (yellow line) are decreasing and closings remain stagnant.But this growth is based on existing breweries’ resiliency—them finding new ways to sell beer as the market evolves results in very few closings. Meanwhile, new openings have been decreasing year over year for at least three years, from around 1,100 new in 2018 to around 400 new in 2021.

If nobody’s closing, but a diminishing few are still opening, that constitutes growth. But the bigger picture is that the market is likely approaching some degree of saturation in some areas. Watson say that in some locales, “it’s one in, one out,” reflecting craft breweries having reached a sort of carrying capacity. But that’s spotty and differs by region.  In an interesting turn of events, after an early pandemic flourish of brewery closings, they remained unexpectedly resilient. In fact, there were fewer closings over the past 20 months than would have been predicted even BEFORE the pandemic.

In an interesting turn of events, after an early pandemic flourish of brewery closings, they remained unexpectedly resilient. In fact, there were fewer closings over the past 20 months than would have been predicted even BEFORE the pandemic.

Underlying demographic, generational shifts provide a crystal ball

In parallel to, and often obfuscated by the short term, immediate, and quickly recognizable pandemic-related market shifts, the U.S. is changing.“Right now, in this country, we're in the midst of two huge generational transformations,” Watson says. “Millennials, who are now mid- to late-twenties through early forties, are settling down, forming families, and changing the way that they act as young adults into older adults. Baby Boomers are starting to retire. They’re people who tend to consume beverage alcohol in a little bit less in volume, and maybe they still spend a little bit more, but they are also a big transitional period. And Generation Z is coming of age, with some signs that they're going to have pretty different preferences on all sorts of things, but beverage alcohol in particular. We’ll ignore Gen X, like everyone else has always done.”

What are the immediately noteworthy takeaways coming out of this generational shift? Watson has a few:

- The market shifts older as the nation shift older. The 35-44 and 45-54 market of craft beer drinkers has increased when comparing 2019 to 2013, so craft brew appears to have a generational cohort that’s aging through the spectrum.

- Craft brew doesn’t resonate with the younger generations as well as it could [Graph 22]. What needs to be done? Local, for instance, is less important to them. Alcohol in general is less important to them—could non-alcoholic (NA) beer be an answer here?

- Alcohol by volume (ABV) is increasingly important among craft brew drinkers. Does it need to be on your label? If it is already, does it need to be more prominent or more easily accessible?

- In 2019, the number of young women who drink surpassed the number of young men who drink. This doesn’t take volume into consideration—young men drink more in volume. But what can craft beer do for women who have historically been groomed for wine, now have options in the RTD spirits beverages alongside seltzers and other non-beer options? There’s an untapped market for craft, in a sense.

- According to a study by Rabobank last year, “Spending is increasingly female, and spending is increasingly BIPOC (Black, Indigenous, and People of Color). Some might say that overall U.S. demographics are doing the same, but those spending increases were happening even faster than that. How can craft beer get out to those ‘new’ markets with greater buying power?

“What we're seeing in some of the numbers is frankly posing a little bit of a challenge in the craft industry, which, as we all know, is heavily over-indexed white male historically,” Watson says.

Indeed, craft brew ownership numbers are 93% white and 76% male. This has the industry at a bit of a reckoning as to what’s next. The Brewers Association is rolling out several measures, including the Thrive program and free, downloadable #NotMe app, in order to address this apparent demographic disconnect and recalibrate itself to align with un-captured potential demographics. The Association is also convening the BRU (Brewing, Respect, Unity) Coalition, designed to foster an equitable and inclusive brewing community. Read more about these and other programs at the Brewers Association web page, but suffice it to say they are largely aimed at social equity and inclusivity.

For this Packaging World editor, this can be seen as a microcosm of the wider packaging and CPG industry, which in recent years has sought to be more inclusive in their packaging designs. And it’s not all altruism, or simply doing good for good’s sake. There was a cost-benefit analysis done by CPG brands that there were billion(s) of differently abled folks being underserved by packaging, and the market is reacting to recapture them. After all, as Watson says, consumers are “omni-bibulous,” meaning they tend not to drink only the same things, even within the beverage alcohol category.

Meanwhile, the beverage alcohol marketplace is reacting by filling unfilled niches and creating new formats to grab some of those potential consumers whom craft hasn’t captured. The ‘beyond beer’ categories of ready-to-drink (RTD) spirits, canned wines, kombucha, and the latest spritzers and seltzers stand out among them. How far craft brewers can lean back outside of their core beer competency to capture back some share remains to be determined, but they’re increasingly trying to do so.

In the Brewers Association’s 2021 annual survey, 33% reported ‘beyond beer’ as a part of their volume, and the percentage of volume is growing, up to 8.9% from 3.4% the previous year.

The landscape is changing, the market is reacting, and if craft brew is to continue to grow into a new generation and demographic mix, it will hav to reinvent itself. It appears it's already trying to do so, but it remains to be seen what share of the new market pie it can capture. -PW